Teknia maintains solid operating profitability in a year with adjustments

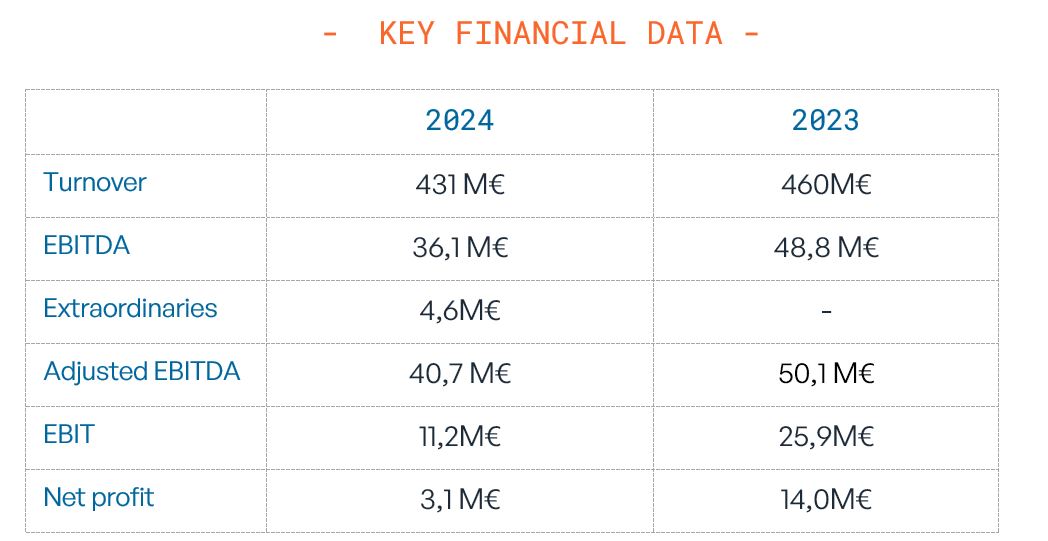

- The company recorded sales of €431 million in 2024, down 6% compared to the previous year

- Teknia reported an EBITDA of €36.1 million, including a one-off impact of €4.6 million related to the adjustment plan carried out during the year

- The company continues to generate cash, maintains stable debt levels, and reaffirms the strength of its financial profile

Elorrio, 23 May 2025 – Teknia, a multinational company specialising in the manufacture of metal and plastic components for mobility, recorded revenues of €431 million in 2024, down 6% from the previous year, when the company achieved the highest sales in its history. The year was marked by temporary operational efficiency adjustments aimed at responding to a challenging automotive sector context, characterized by a slowdown in electrification-related projects —particularly in Europe— and restrained vehicle production volumes.

EBITDA stood at €36.1 million, 26% lower than the previous year, reflecting a negative impact of €4.6 million in extraordinary costs, mainly related to workforce adjustments. These adjustments were part of the ‘Elcano Plan’. It is an operational efficiency and cost optimization program launched by Teknia in response to an exceptional market situation. The plan aims to prepare the company for the future. Thanks to this plan, the group achieved €5 million in recurring annual savings.

The workforce measures were implemented in a planned and long-term way. They affected 4% of staff in Europe and 1.2% across the entire company. In addition, Teknia temporarily paused its M&A activity in 2024 to focus on an inorganic growth strategy outside Europe in 2025. This strategy will focus on North America also under the scope of the “Elcano Plan”.

The company maintains its financial strength

Adjusted EBITDA, excluding the impact of extraordinary adjustments, reached €40.7 million. It demonstrates the strength of Teknia’s operations even in an exceptionally demanding year marked by a sharp slowdown in the sector. This resilience is supported, among other factors, by a highly diversified customer base that reinforces the Group’s stability and reaffirms its operational strength.

Teknia also achieved an Operating Cash Flow (OCF) conversion rate of 24% of its annual EBITDA. The rate reinforces the Group’s capacity to fund growth and continue reducing debt. Net Financial Debt (NFD) remained stable at €85 million during the period (2.09x NFD/EBITDA), despite the high-interest rates environment. This achievement underscores the financial strength of Teknia’s business model. Finally, net profit stood at €3.1 million, down 78% compared to 2024.

In addition, during the year, the company continued to make key investments in innovation and modernization, which was €39 million in 2024. Through these investments, Teknia aims to further strengthen its industrial capabilities and future competitiveness in response to the paradigm shift currently transforming the automotive sector.

Javier Quesada de Luis, CEO of Teknia, stated: “The 2024 results reflect our ability to quickly adapt to an adverse temporary situation and make bold decisions to safeguard our future profitability. Although we have undertaken extraordinary adjustments, we have done so to protect the future of our company and our team.” Quesada de Luis also emphasized that “our business model is resilient, as demonstrated by the adjusted EBITDA, and at Teknia we remain strongly committed to our strategic plan, with a continued focus on efficiency, innovation, and sustainable growth.”

Interested in our Press Kit?