Teknia improves profitability and net profit in a challenging first half

- The company improves net profit by 14.6% due to greater control of expenditures, increased industrial efficiency and prudent financial management

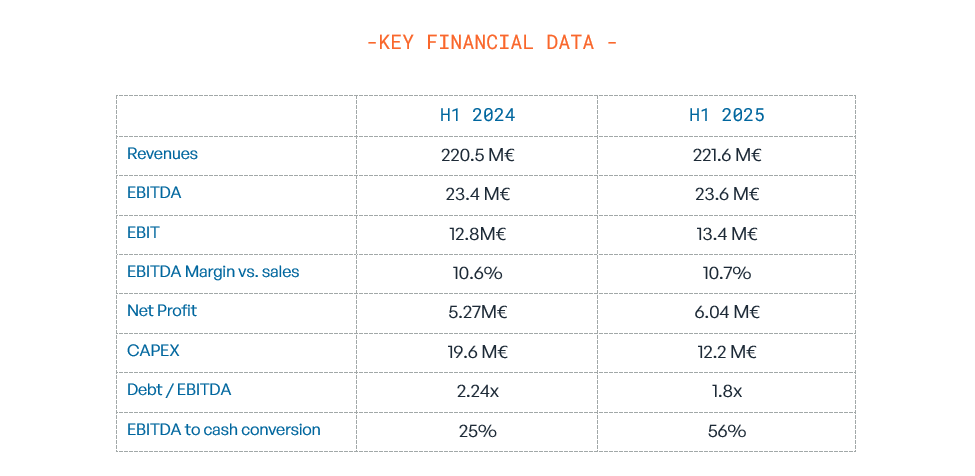

- EBITDA reached €23.6 million and turnover grew to €221.6 million, with an improvement in margin to 10.7%

- During the first half of the year, Teknia completed the sale of its plant in Gebze (Turkey), the only facility that the Group had been operating in the country since 2017

Elorrio, 4 August 2025 – Teknia, a multinational company specialising in the manufacture of metal and plastic components for mobility, improved its profitability and increased its net profit to €6.04 million in the first half of 2025, representing an increase of 14.6% over the same period last year. This improvement comes amid challenging conditions for the automotive sector and reflects the strength of the company’s operating model.

Revenue amounted to €221.6 million, up 0.5% on the first half of 2024. The company thus outperformed the market, which fell by 3.2% in the countries where it operates during the same period. EBITDA reached €23.6 million, up 1.1% on the first half of 2024. As a result, the EBITDA margin on sales rose to 10.7%. This result reflects the resilience of the Group’s industrial model, which has been able to adapt to a complex environment affected by uncertainty in the automotive industry and the slowdown in production volumes in the sector.

EBITDA cash conversion reached a record 56%, compared to 25% in the same period in 2024, as a result of the focus on operational efficiency, spending discipline and prudent management in a volatile environment. The net debt/EBITDA ratio fell significantly to 1.8x, demonstrating Teknia’s strong financial profile and the company’s ability to face the future. Investments decreased from 19.6 million euros in 2024 to 12.2 million euros in 2025.

By geography, the market that performed best during the period was Brazil, which grew by 15.7% compared to the first half of 2024, significantly outperforming the market. Teknia also outperformed the market in Western and Eastern Europe.

Teknia sells its plant in Turkey and reaffirms its BB+ financial rating

During the first half of the year, Teknia completed the sale of its plant in Gebze (Turkey), the only facility that the Group had been operating in the country since 2017, given the high level of uncertainty in the local market and its small size within Teknia’s plant network. The transaction is part of the implementation of the “Elcano Plan”, which aims to increase the Group’s efficiency and competitiveness by focusing its activity on larger-scale plants of greater strategic importance.

In addition, the rating agency Ethifinance reaffirmed Teknia’s overall BB+ rating, highlighting its solid financial profile, with leverage and interest coverage at controlled levels. Also, they gave a positive assessment of the recurring operating cash flow, which returned to positive free cash flow in 2024, and the progress made in sustainability and governance, thanks to good ESG practices that strengthen the company’s position in the market.

Javier Quesada de Luis, CEO of Teknia, stated that “these results demonstrate Teknia’s ability to control spending and achieve greater industrial efficiency through prudent financial management. Teknia proves its ability to adapt to the demanding environment of the sector, with a slowdown in vehicle manufacturing volumes. In this regard, the “Elcano Plan” of operational adjustments is proving successful in making our operations more efficient and placing us in a good position to face the future.”

Interested in our Press Kit?