Teknia breaks its record with a turnover of 460 million euros in 2023

- Turnover increased by 20% and almost doubled the growth of the markets in which the company is present (11%)

- EBITDA reached €48.8 million, up 20% year-on-year, and profitability continued to improve to 10.6%

- Teknia made investments in 2023 of 31.2 million euros, 6.8% of sales, to accompany the production of the new deposits in addition to continuing to raise its technological level

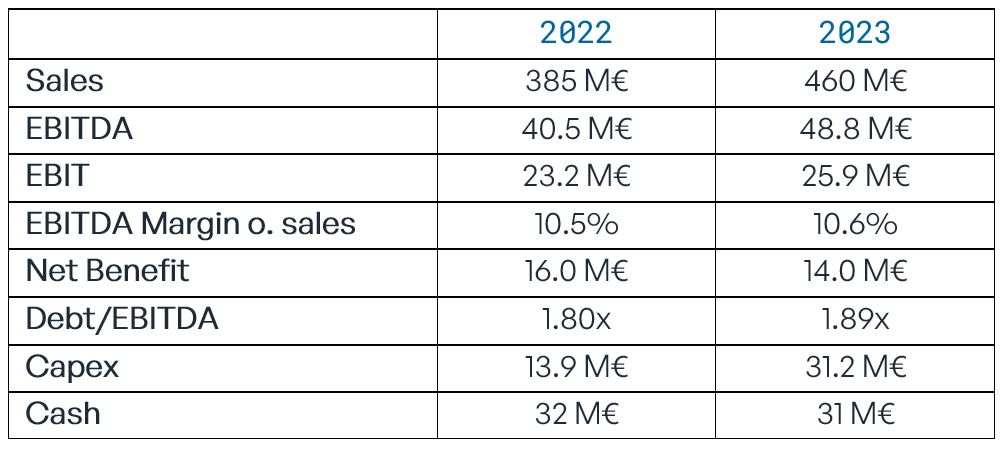

Elorrio, 29 May 2024 – Teknia, a Spanish multinational specialising in the manufacture of metal and plastic components for mobility, recorded a turnover of €460 million in 2023, 20% more than the previous year, when the company had a turnover of €385 million, which was already a record for the Basque manufacturer. This is a new historic turnover for the Group, which continues the growth path of recent years. In addition, this increase is almost double that recorded by the markets where the company operates, which was 11%.

Teknia’s EBITDA also reached a record figure of €48.8 million, more than 20% higher than in 2022, while EBIT was €25.9 million, up 12%. Teknia closed 2023 with a net profit of €14 million.

Thanks to efficient management, the company achieved its highest profitability in the last four years, reaching 10.6% while maintaining an upward trend. The Group thus demonstrated the solidity of its business model, embodied in the ‘Moving Teknia 2025‘ strategic plan. This plan, presented last year, sets specific economic objectives for the Group to exceed 600 million euros in turnover and continue to increase its profitability by 2025.

In turn, Teknia increased its investments in 2023 to €31.2 million, representing 6.8% of sales, compared to €13.9 million the previous year. This investment effort seeks to ensure the production of the new catchments and continue with the improvement of its technologies in order to continue strengthening the company’s position in the market.

With regard to inorganic growth, in 2023 the company continued its international expansion strategy and acquired its first factory in Sweden. The plant, called Teknia Vimmerby, is dedicated to the injection and machining of aluminium and magnesium products for safety and high-precision parts in the steering and chassis. In this way, Teknia reinforces its commercial strategy in key solutions for the electrification of the vehicle, while incorporating magnesium injection into its technological portfolio.

In terms of debt levels, Teknia continued with its containment objective initiated 3 years ago. Thus, despite the investment activity in CAPEX and M&A, gross net debt levels remain at a ratio of 1.89 times EBITDA, below the target of 2 times EBITDA that the Group has set itself in recent years to deal with the current geopolitical instability. In this way, it shows its firm commitment to its employees and stakeholders, guaranteeing them the stability, trust and commitment of this family business in the face of its present and future responsibilities.

Javier Quesada de Luis, CEO of Teknia, said that “the 2023 figures show how Teknia continues to focus on its profitable and sustained growth plan. We recorded the highest sales in our history, improved our profitability and achieved record EBITDA. The results show that the company is on the right track to achieve the ambitious goals we set ourselves in our strategic plan. In a challenging market context, we managed to almost double the performance of the markets in which we operate.” He also added that “this highlights the strength of our business model and positions us as an innovative company that faces the growth opportunities offered by the new mobility in good conditions”.

Interested in our Press Kit?